Worldwide Commercial Insurance Industry to 2027

[ad_1]

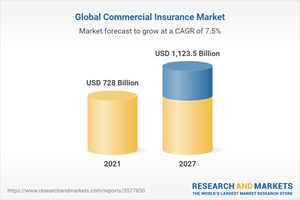

Global Commercial Insurance Market

Dublin, June 07, 2022 (GLOBE NEWSWIRE) — The “Commercial Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027” report has been added to ResearchAndMarkets.com’s offering.

The global commercial insurance market reached a value of US$ 728.0 billion in 2021. Looking forward, the market is projected to reach a value of US$ 1,123.5 billion by 2027, exhibiting a CAGR of 7.20% during 2022-2027. Keeping in mind the uncertainties of COVID-19, the analyst is continuously tracking and evaluating the direct as well as the indirect influence of the pandemic on different End-use industries. These insights are included in the report as a major market contributor.

Commercial insurance refers to a type of coverage for businesses and corporations designed to protect the organization, its employees, and its ownership. Some commonly offered commercial insurance policies include property insurance, general liability, commercial auto insurance, workers’ compensation insurance, business interruption insurance, cyber liability insurance, and crime coverage. It covers the company against losses and risks, such as property damage, injury to the employees, cyberattacks, thefts, natural disasters, data breaches, and liability lawsuits that could potentially disrupt the business operations. In recent years, commercial insurance has rapidly gained traction among startups and enterprises as it protects the assets of the insured business from unexpected events and covers the financial losses incurred.

Commercial Insurance Market Trends

Commercial insurance offers security for business operations, protects the company’s reputation, and ensures the wellbeing of its employees and financial situation. As a result, the rising awareness regarding the benefits of commercial insurance policies among enterprises represents the primary factor driving the market growth. Besides this, the increasing number of small- and medium-sized enterprises (SMEs) and the growing need to protect businesses against unexpected losses are augmenting the demand for commercial insurance.

Additionally, regional governments of various countries are taking favorable initiatives to encourage employers and business owners to purchase different types of coverage, such as workers’ compensation insurance for employees and commercial auto insurance for business-owned vehicles. Along with this, the rising number of commercial insurance providers is catalyzing the market growth.

Furthermore, the leading players are adopting advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to offer enhanced services like personalized and convenient insurance plans with lower premium costs to improve customer loyalty and gain a competitive edge. Other factors, including the growing usage of telematics devices across various industries, rising competition among businesses, technological advancements, and rapid industrialization, are also creating a favorable outlook for the market.

Key Market Segmentation

This report provides an analysis of the key trends in each sub-segment of the global commercial insurance market, along with forecasts at the global, regional and country level from 2022-2027. The report has categorized the market based on type, enterprise size, distribution channel and industry vertical.

Breakup by Type:

Breakup by Enterprise Size:

Breakup by Distribution Channel:

-

Agents and Brokers

-

Direct Response

-

Others

Breakup by Industry Vertical:

Breakup by Region:

-

North America

-

United States

-

Canada

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Others

-

Europe

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

Russia

-

Others

-

Latin America

-

Brazil

-

Mexico

-

Others

-

Middle East and Africa

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players being Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company and Zurich Insurance Group Ltd.

Key Questions Answered in This Report

-

How has the global commercial insurance market performed so far and how will it perform in the coming years?

-

What has been the impact of COVID-19 on the global commercial insurance market?

-

What are the key regional markets?

-

What is the breakup of the market based on the type?

-

What is the breakup of the market based on the enterprise size?

-

What is the breakup of the market based on the distribution channel?

-

What is the breakup of the market based on the industry vertical?

-

What are the various stages in the value chain of the industry?

-

What are the key driving factors and challenges in the industry?

-

What is the structure of the global commercial insurance market and who are the key players?

-

What is the degree of competition in the industry?

Key Topics Covered:

1 Preface

2 Scope and Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Commercial Insurance Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Liability Insurance

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Commercial Motor Insurance

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Commercial Property Insurance

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Marine Insurance

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by Enterprise Size

7.1 Large Enterprises

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Small and Medium-sized Enterprises

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Distribution Channel

8.1 Agents and Brokers

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Direct Response

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Others

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Industry Vertical

9.1 Transportation and Logistics

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Manufacturing

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Construction

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 IT and Telecom

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Healthcare

9.5.1 Market Trends

9.5.2 Market Forecast

9.6 Energy and Utilities

9.6.1 Market Trends

9.6.2 Market Forecast

9.7 Others

9.7.1 Market Trends

9.7.2 Market Forecast

10 Market Breakup by Region

11 SWOT Analysis

12 Value Chain Analysis

13 Porters Five Forces Analysis

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Allianz SE

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.1.3 Financials

15.3.1.4 SWOT Analysis

15.3.2 American International Group Inc.

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.2.3 Financials

15.3.2.4 SWOT Analysis

15.3.3 Aon plc

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.3.3 Financials

15.3.3.4 SWOT Analysis

15.3.4 Aviva plc

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.4.3 Financials

15.3.4.4 SWOT Analysis

15.3.5 Axa S.A.

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.5.3 Financials

15.3.5.4 SWOT Analysis

15.3.6 Chubb Limited

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.6.4 SWOT Analysis

15.3.7 Direct Line Insurance Group plc

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.7.3 Financials

15.3.8 Marsh & McLennan Companies Inc.

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.8.4 SWOT Analysis

15.3.9 Willis Towers Watson Public Limited Company

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.9.3 Financials

15.3.9.4 SWOT Analysis

15.3.10 Zurich Insurance Group Ltd.

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.10.3 Financials

15.3.10.4 SWOT Analysis

For more information about this report visit https://www.researchandmarkets.com/r/g6bsyf

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link