UK recessions risks on the rise; global trade hit; Russia edging closer to default – as it happened | Business

[ad_1]

Good morning, and welcome to our live rolling coverage of business, economics and financial markets.

The financial pressures on many UK households and businesses have intensified today, as national insurance rates are lifted to raise funds for the NHS and social care.

Despite the cost of living crisis, the government has pressed on with its manifesto-busting 1.25 percentage point rise in national insurance, announced last September.

The move means millions of workers will begin paying higher National Insurance contributions from today, the start of the new tax year.

Businesses will also see their contributions rise, at a time when they’re already juggling rising costs. Tax rates for dividend income also rise by 1.25 percentage points.

Businesses groups, unions and some Conservative MPs had all pushed the government to delay the increase, given the financial pressures on workers and companies.

The “Health and Social Care Levy” is expected to raise around £12bn per year, to tackle the backlog of cases at the NHS due to the pandemic, and also reform routine services.

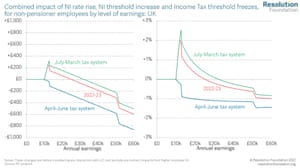

Today’s changes mean those earning above £9,880 will now be liable for 13.25% NI contributions, up from 12%. Earnings above £50,270 will be charged a rate of 3.25%, up from 2%.

But from July, national insurance will only start to be charged on earnings over £12,570, because chancellor Rishi Sunak announced a £3,000 rise in the NI threshold in last month’s spring statement. That will take around two million workers out of direct tax altogether (if they earn less than £12,570 per year).

According to Resolution Foundation, everyone earning less than £32,000 a year will be better off from the combination of those two policies from July.

But there are other changes kicking in for the new tax year, including a freeze on income tax thresholds. That will drag more people into paying tax, or more tax, if their pay increases over the next few years.

That will make it harder for households to handle rising costs, such as last week’s surge in energy bills.

Resolution Foundation

(@resfoundation)April 2022 will see the UK’s cost of living crisis intensify as energy prices jump by more than half overnight, pushing 5 million English households into fuel stress, even accounting for support measures recently announced by the Chancellor: https://t.co/1sL3kMHK30 pic.twitter.com/6O4gOARCCp

Prime minister Boris Johnson has defended the National Insurance increases, saying the health service needs the extra resources:

We must be there for our NHS in the same way that it is there for us. Covid led to the longest waiting lists we’ve ever seen, so we will deliver millions more scans, checks and operations in the biggest catch-up programme in the NHS’ history.

We know this won’t be a quick fix, and we know that we can’t fix waiting lists without fixing social care. Our reforms will end the cruel lottery of spiralling and unpredictable care costs once and for all and bring the NHS and social care closer together. The Levy is the necessary, fair and responsible next step, providing our health and care system with the long term funding it needs as we recover from the pandemic.

The government says the levy means:

- From today the Health and Social Care Levy will begin raising billions to tackle Covid backlogs and reform routine services

- £39 billion over the next three years will put health and care services on a sustainable footing

- Levy will deliver biggest catch up programme in NHS history and end spiralling social care costs

The agenda

- 7am BST: German factory orders for March

- 9.30am BST: UK construction PMI report for March

- 3.30pm BST: EIA weekly US oil inventories

- 7pm BST: US Federal Reserve publishes minutes of latest meeting

[ad_2]

Source link