Top Hourly Payroll Process Tips for 2022

Running payroll isn’t exactly fun. But every business owner needs to do it if they want to keep employees happy (and paid!)

The payroll process covers everything that goes into paying employees while staying compliant with labor and tax laws — like registering for tax IDs, accurately tracking hours, calculating and withholding taxes, and sharing pay stubs.

It’s a lot, we get it. That’s why we’re going to help you learn what payroll actually is, how to do it right, and what steps go into selecting the right software to set up your payroll process.

What is payroll?

Basically, payroll is the process of paying your employees. It includes tasks like figuring out taxes — including social security and Medicare tax — and tracking hours worked.

Converting timesheets into hours, processing tax filings and issuing 1099s, W-2s, and W-4 forms, offering perks, and actually distributing your employee’s paychecks — all of this falls under the umbrella of payroll.

As a small business owner, you’re probably handling payroll on your own. In larger organizations, this might be delegated to an HR professional or accountant. Luckily, smart tools like Homebase offer everything you need to get the job done right without hiring extra people.

How payroll works with small businesses

Payroll works differently for smaller businesses, mainly because their needs are different and they don’t need all the bells and whistles that a larger company might. Those extras tend to come with steep learning curves (and price tags!)

The other key difference is that many small businesses choose to pay their employees on an hourly basis. And since hourly payroll is different from salary payroll, it requires different processes and tools.

Hourly payroll is based on a rate per hour and employees are paid according to how many hours they work. Salaried employees, on the other hand, get paid a set amount each month. Hourly payroll requires careful calculation of each employee’s timesheets and overtime, so time clocks and employee scheduling software are often a necessity.

The different elements of payroll

There are a lot of processes and tasks that go into running payroll, and it’s not an easy task to take on: you need to collect employee information, set up a payroll schedule, calculate and deduct tax withholdings, and a whole bunch of other stuff that can quickly feel pretty overwhelming.

Remember that you’re not on your own, and you don’t have to DIY payroll for your entire business. Now, let’s break some of these payroll elements down a little.

Payroll schedules

For small businesses with hourly workers, a payroll schedule is a combination of a pay period, a time period where employees worked, and a pay date (the day your employees receive their checks).

The most common payroll schedules in the US are weekly, biweekly, semi-monthly, and monthly. Weekly schedules are best for small businesses because they simplify calculating overtime payments, which are usually irregular. This way, employees also get paid as soon as possible, which gives them more control and flexibility over their finances.

Choosing the right schedule for your business is crucial because it affects everything from payroll processing costs to employee morale to compliance with state and federal laws.

Payroll taxes

Calculating and withholding taxes are essential elements of running payroll. Taxes and rates can also vary by state, which can make this whole process more complicated.

Good news: there are only five federal and state payroll taxes you need to know to get started:

Once you have that down, check if your business is subject to any additional state or local taxes.

Health insurance contributions

Offering health insurance to employees is a great benefit that can set your business apart and attract top talent in a competitive labor market. But if you’re mainly running the show by yourself, figuring out how health insurance contributions and payroll taxes interact can be daunting.

Basically, employer-sponsored health insurance premiums are pre-tax for both employees and employers. That means the money you spend on employee health insurance premiums can be exempt from federal taxable income and payroll taxes (of course, you should always check with your Certified Public Accountant!)

So before you calculate and withhold tax, make sure to take any benefit contributions and deductions into account.

Payroll costs

There can be quite a few costs associated with running payroll smoothly. But depending on the type of payroll system you use and whether you outsource these activities or not, your payroll costs can vary a great deal. If you’re using a payroll service solution, you’ll have expenses like:

- A base monthly fee and fees for each employee you have on payroll

- 401k distribution

- Tracking employee time

- Workers’ compensation

- Direct deposit, state, and federal tax filings

- Paid leave and overtime pay

- Bonuses

Payroll summary reports

A payroll summary report shows you an overview of all your payroll activities. This includes employee details like net and gross pay and employer taxes. Maintaining and properly storing these documents is crucial as you’re required by the federal government to submit several payroll report forms, including Form 940, Form 941, W-2s, and W-3s.

You may also be responsible for a local payroll report, so make sure to check your local employment laws to cover your bases.

How to select the perfect payroll software for your business

You can definitely process your own payroll manually, but it’s a complicated process that can leave room for errors. That’s where payroll software comes in. These tools help you reduce labor costs, stay compliant with federal and state laws, and make fewer payroll errors.

There are many different types of payroll software, including solutions like Gusto, BambooHR, and OnPay. But most of these platforms aren’t made specifically with hourly workers and small businesses in mind. That means they don’t offer an all-in-one solution with tools for scheduling, time tracking, automatic deduction calculations, and all the other functions that are a must for hourly payroll.

Plus, they’re often designed for larger companies and aren’t geared towards businesses with under 20 employees.

So when choosing a payroll provider, make sure it’s not only secure and scalable but actually made for a business like yours!

How to set up and process your payroll

When it comes to actually setting up your payroll system, there are a few important things to keep in mind. Before you get into the nitty-gritty of it, decide what your payroll policies will be and how you’ll handle the process.

Will you be handling everything in-house? Or would you prefer to outsource it to an accountant or online payroll service? And what’s your payroll schedule going to look like? Don’t forget to document your policies so everything is publicly available and can be communicated to your employees transparently.

Then, register as a business with the IRS and get your employer identification number (EIN). Make sure every member of your team completes the correct tax forms, and then calculate how many federal and state taxes you need to withhold from each of your employee’s earnings.

As an employer, you must also submit your federal tax return each quarter. Then, at the end of every year, you’ll have to prepare your annual filings, including your W-2s for every staff member.

Finally, calculate your salaries and pay your employees. All that may sound like a lot, but the process can be summarized into these ten steps:

- Get your employee’s EIN

- Register with the Electronic Federal Tax Payment System (EFTPS)

- Learn your area’s payroll laws

- Determine your payroll schedule

- Report new employees to the state

- Prepare the proper paperwork like W-4s

- Figure out new hire pay rates

- Calculate tax deductions and state taxes

- Disperse paychecks and maintain records

- Use accounting software to help along the way

That’s right — it can be tricky to run small business payroll yourself. But if that’s the path you want to take, it’s definitely possible with some patience and effort!

How Homebase streamlines payroll for hourly employees

There are many steps involved in carrying out the payroll process on your own, and they can be difficult and exhausting to accomplish, especially if you don’t use any HR services to assist you.

Payroll software specifically designed for small businesses can help a great deal. It saves you the headache of having to remember every single payroll step yourself and running the risk of falling out of compliance, even accidentally. That’s why we’ve highlighted how Homebase can simplify your payroll and help you stay compliant with ease.

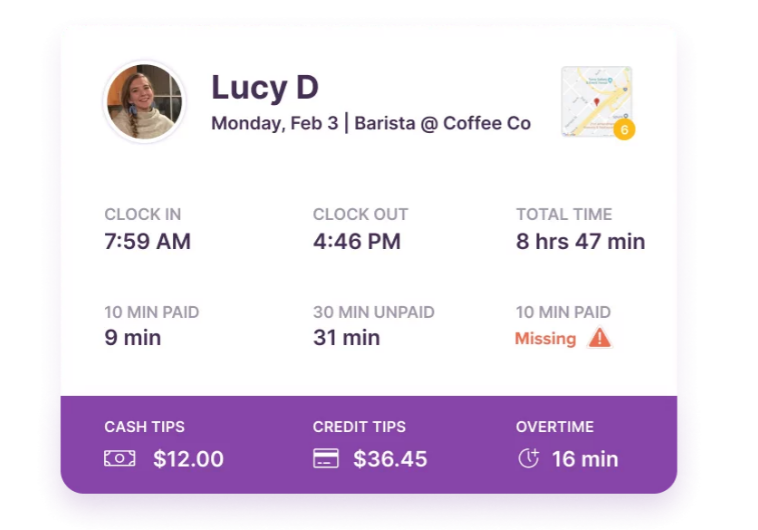

Time clocks

This feature lets you turn almost any device with an internet connection into an employee time clock system. All you need to do is download the online time clock for employees and sign in. Then, team members can clock in and out with the time clock by using their personalized pins.

After that, you’ll be able to track hours, breaks, overtime, and paid time off. Homebase will instantly convert your timesheets into hours and wages in payroll. Timesheets and payroll, all in one place!

Scheduling

Homebase’s scheduling solution helps you optimize employee schedules and makes sure you and your team are always on the same page.

Instantly share your schedule with your employees, use templates or auto-scheduling to optimize shifts, automatically remind employees of upcoming shifts via text, and get alerts to avoid overtime hours.

An optimized schedule also makes it easier to track an employee’s total hours and find out how much overtime you have to account for, which translates into easier payroll calculations at the end of your pay schedule.

Integrations

Homebase offers various integrations, so you don’t have to worry about entering and transferring data manually if you’re already using payroll solutions like Quickbooks or Square.

From Shopify and Paychex to Vend and Toast, we make sure your whole tech stack is automatically in sync, saving you time and cutting out unnecessary extra data entry.

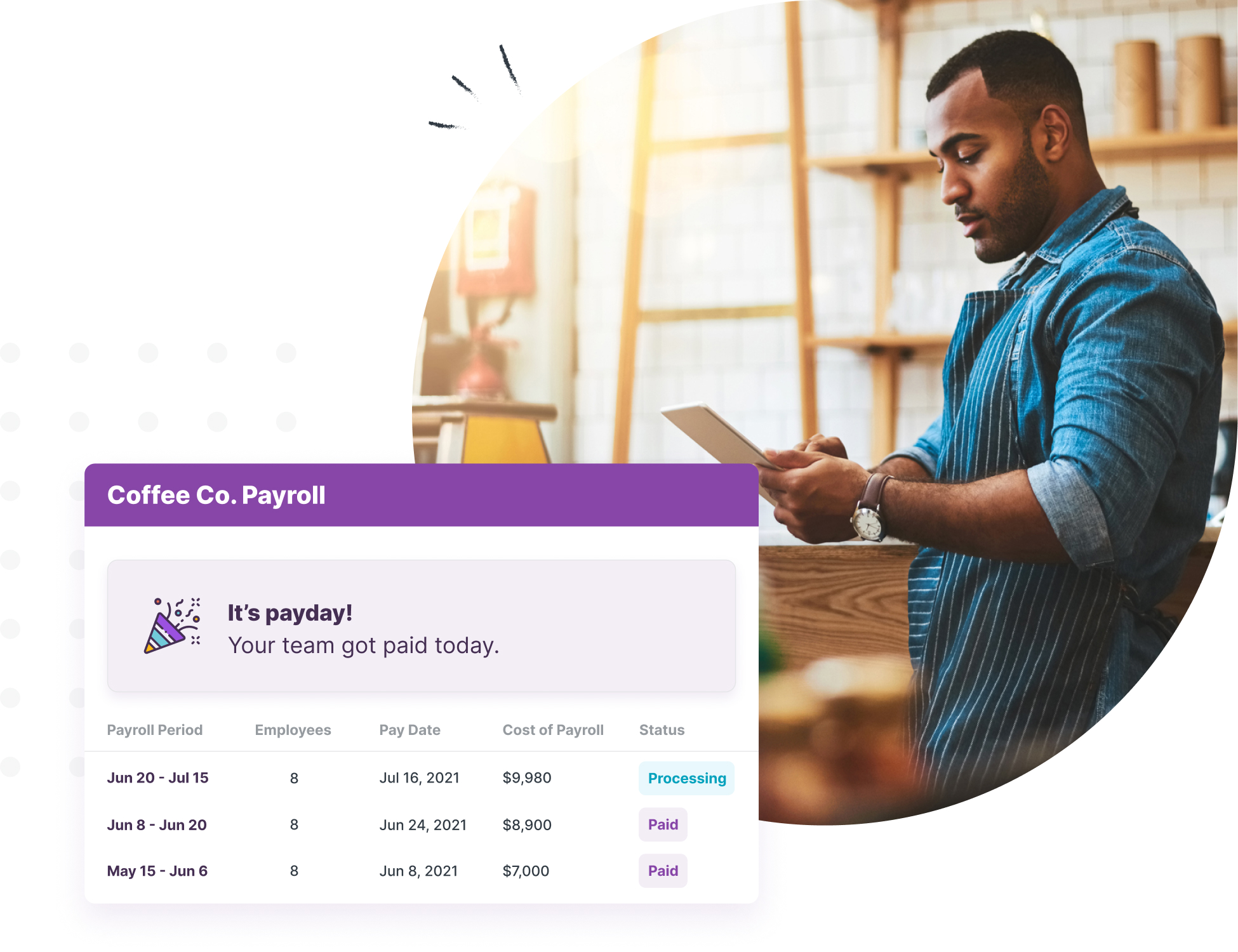

Payroll

Last but definitely not least, our payroll solution automates the whole payroll process so you can focus on the important stuff. Here’s what we do:

- Calculate wages and taxes and send out correct payments to employees, the state, and the IRS.

- Automatically process your tax filings and issue 1099s and W-2s.

- Store your time card records to help you stay compliant with FLSA record-keeping rules.

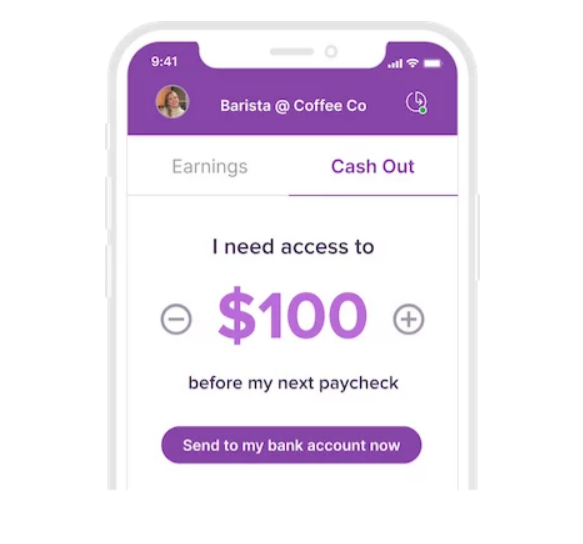

As an added perk for your team, they’ll have the option to access a portion of their wages before payday. This gives employees more control when unexpected expenses hit, and comes at zero cost or hassle for you.

Seamless payroll is just a click away

Running payroll as a small business owner is complicated because it involves so much more than just figuring out wages and transferring payments.

You need to calculate and withhold taxes, stay compliant with federal, state, and local laws, prepare payroll reports, and decide on a consistent payroll schedule. And you have to do all that while actually running your business.

If that sounds too time-consuming and confusing, we’ve got you covered! Homebase automates your payroll process and takes care of everything from converting your timesheets into hours and wages to automatically processing your tax filings. You just focus on growing your business and doing what you love!