Texas Instruments: Automotive Growth Continues

[ad_1]

Sundry Photography/iStock Editorial via Getty Images

In our previous analysis of Texas Instruments (NASDAQ:TXN), we analyzed its business segments with a diversified revenue base but an increasing focus on its higher-growth segments which are its industrial and automotive segments with a forecast CAGR of 5.8% and 9.7% respectively. Moreover, we analyzed its profitability driven higher by its focus on 300mm wafers and internal production strength amid the tight supply environment. Lastly, we see its direct sales increasing as it streamlined its distribution channels to focus on Arrow which is its largest distributor.

In this analysis, we focused on its automotive segment as its highest growth segment by analyzing its products including power semiconductors and compared it against competitors based on its product breadth to determine whether it has an advantage and forecasted its revenue growth.

Additionally, we then looked into its automotive SoC products for ADAS and infotainment applications. We also compared it with its competitors to determine if it has a performance advantage and projected its revenues for this product.

Lastly, we analyzed its MCU business with its product development with a comparison to competitors. We then forecasted its revenue growth based on our analysis of the automotive MCU market.

Solidifying Market Share in Automotive Power Semiconductors

Texas Instruments has a broad portfolio of automotive power chips such as BMS, DC/DC Switching regulators, linear regulators and voltage supervisors. These types of chips are used broadly in vehicles across different applications including the powertrain, infotainment, ADAS and more. The diagram below by Toshiba shows the various applications using semiconductors in automotive vehicles.

Toshiba Electronic Devices & Storage Corporation

To determine Texas Instrument’s product competitiveness for its automotive semiconductors, we compared the breadth of the portfolio against leading power IC companies with different types of power management ICs based on data from Arrow Electronics (ARW), the world’s largest electronics distributor with a market share of around 37%, including DC/DC converters which converts DC from one voltage to another, power controllers which manage the level of current in devices, drivers such as gate drivers which amplifies low-power input from a controller to control a transistor and voltage references to maintain a constant output voltage.

|

Power Management Products |

Texas Instruments |

Infineon |

STMicro |

Analog Devices |

|

DC to DC Converters |

8,037 |

791 |

669 |

6,644 |

|

Power Controllers |

2,690 |

454 |

366 |

4,403 |

|

Drivers |

1,210 |

1,054 |

217 |

494 |

|

Voltage references |

3,277 |

– |

202 |

2,281 |

Source: Arrow Electronics

Based on the table, we found Texas Instrument’s product breadth to be superior to competitors with the highest number of products in DC-DC converters, drivers and voltage references. Furthermore, Texas Instruments has been targeting new developments in areas such as BMS for EVs and controllers for infotainment and ADAS as seen in the table below. It had also announced a BMS solution with wireless communication protocol compared to traditional cabling providing automakers with flexibility in design as it claims to reduce the weight burden in EVs as an advantage to cabling. Additionally, as a member of the international safety standard ISO 26262 for automobiles, this highlights its commitment to automotive safety and ADAS.

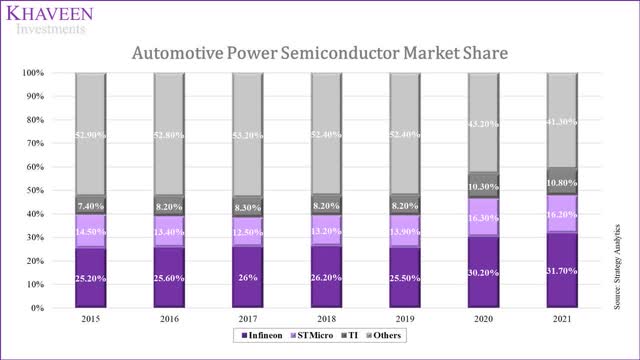

Based on data from Strategy Analytics, Texas Instrument’s market share of automotive power semiconductors has strengthened over the years. In the past 5 years, its market share in this market has grown from 7.4% in 2015 to 10.8% in 2021. Furthermore, the company’s controllers are not only used by automakers and Tier 1 manufacturers but also by other chipmakers such as Intel. Its step-down controller and MOSFET gate driver are incorporated into the system architecture of the Mobileye EyeQ5 enabling advanced ADAS capabilities. The requirements of the advanced SoC from Mobileye require a high number of voltages at low currents as it performs heavy computing workloads. Both solutions are also AEC Q-100 certified to meet stringent automotive regulatory standards. Thus, we expect the company to benefit as Mobileye’s solutions ramp up with an extensive customer base.

Overall, we expect the company to continue growing in the automotive power semicon market with a broad portfolio of power management ICs compared to competitors across various types of power IC devices. Based on data from Omdia, we estimated its revenue based on its market share and projected its automotive power semiconductor revenues to grow based on the market CAGR of 7% through 2025.

|

Automotive Power Semiconductor Forecast ($ mln) |

2021F |

2022F |

2023F |

2024F |

2025F |

|

Automotive Power Semiconductors Revenue |

1,233 |

1,319 |

1,411 |

1,510 |

1,616 |

|

Growth % |

7% |

7% |

7% |

7% |

Source: TI, Omdia, Khaveen Investments

Jacinto SoCs for ADAS and Infotainment Systems

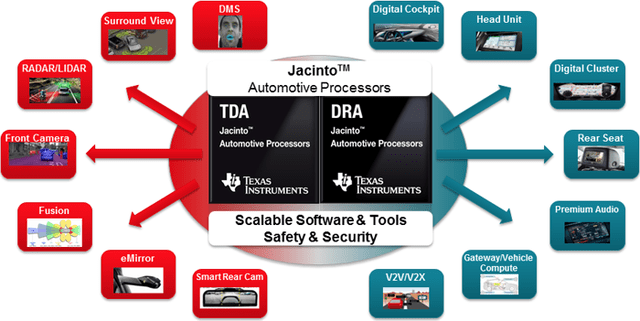

Besides power semiconductors, the company also provides a broad range of products targeting ADAS and infotainment with specialized automotive SoCs. Under its Jacinto SoC product family, it provides two varieties of SoCs for ADAS (‘TDA’) and infotainment applications (‘DRA’). The company has strong customer relationships with over 35 automakers and Tier 1 manufacturers including Ford (F), Volkswagen (OTCPK:VWAGY), SAIC and BMW (OTCPK:BMWYY).

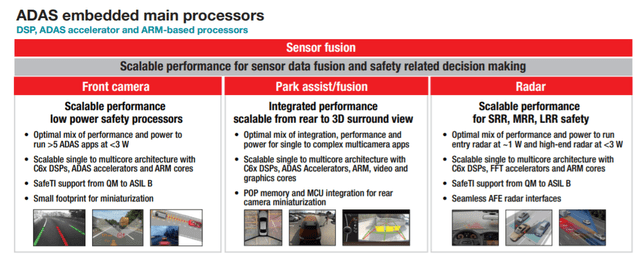

Firstly with ADAS, the company’s TDAx SoCs provide a scalable hardware and software architecture enabling applications such as camera-based, rear, surround view and night vision capabilities as well as radar and sensor fusion.

The TDA4VM is its latest-gen chip launched in 2020 under the Jacinto 7 line. It is built on a 12nm process and offers power efficiency advantages requiring 5 to 20 watts and no special cooling technology required. It claims to enable Level 2 to 3 systems DSP-based deep-learning accelerator (‘DLA’) with 8 TOPs. TOPS stands for “Trillions or Tera Operations per Second” and its measure of maximum achievable throughput to maximum inference efficiency.

As highlighted in our previous analysis, companies like Nvidia with DRIVE offers the highest performance and Atlan products offer the industry’s first 1,000 TOPS with software supporting Level 4 AV development. Also, Mobileye’s EyeQ5 is believed to achieve around 24TOPS with lower power consumption while Qualcomm’s platform is claimed to scale 30 TOPS for L1 to L2 to 700 TOPS at 130W for L4 to L5.

|

Company |

ADAS SoC Performance (‘TOPS’) |

Maximum Vehicle Autonomy Level |

|

Texas Instruments |

8 |

Level 2 to 3 |

|

Intel Mobileye (EyeQ Ultra) (INTC) |

176 |

Level 4 to 5 |

|

Nvidia (NVDA) |

1,000 |

Level 4 to 5 |

|

Qualcomm (QCOM) |

Up to 700 |

Level 4 to 5 |

Source: TI, Mobileye, SlashGear, Qualcomm

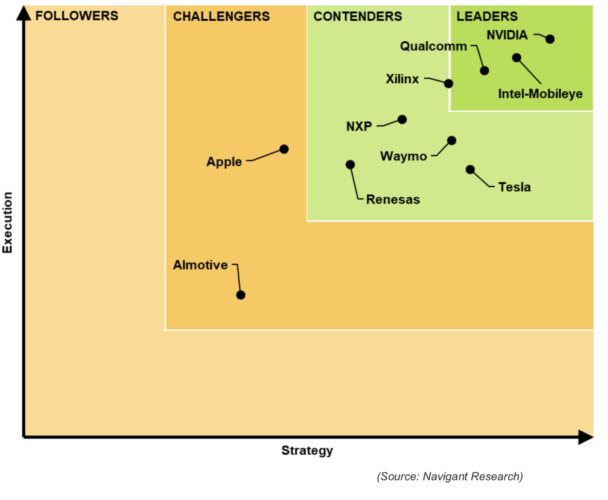

Based on the Navigant Research positioning map of autonomous vehicle chip companies, Nvidia, Mobileye and Qualcomm are placed in the ‘Leaders’ quadrant which supports their strong development in AV. While Texas Instruments is not highlighted on the map, we believe the company would fall under the ‘Contenders’ quadrant with ADAS capabilities limited to Level 3.

Navigant Research

The company has its Jacinto processor line targeted for in-vehicle-infotainment systems in infotainment. Its Jacinto Eco 6 SoCs handle vehicle entertainment and information systems integrating functionalities such as speech recognition, audio streaming and HD video. The main focus of its DRA processors is on vehicle connectivity. Its DRA829V is the industry’s first to feature a “PCIe switch on-chip” and “8 port gigabit TSN-enabled ethernet switch” enabling faster computing performance for automakers and Tier 1 customers such as Volkswagen and Harman.

PCIe or “peripheral component interconnect express” is a form of technology for ethernet connection with high bandwidth and low latency for greater network connections. In automotive, the proliferation of various new technologies such as advanced sensors, ADAS and transmission controls results in greater requirements to connect these systems in a simplified and cost-effective way. In addition, the incorporation of Ethernet Time-Sensitive Networking (‘TSN’) technology facilitates real-time communication enabling faster speeds. Overall, we expect the demand for TI’s SoC to be spurred by the growth of in-vehicle electronic systems and connectivity features. According to Strategy Analytics, it forecasts the automotive Ethernet market is forecasted to grow at a CAGR of 20.9% through 2026.

All in all, we expect the company to continue to develop its Jacinto automotive SoCs for ADAS and infotainment applications. We project its SoC revenues derived from estimates from IHS to grow at a CAGR of 8% through 2025 based on the automotive SoC market forecasts.

|

Automotive SoC Forecast ($ mln) |

2020 |

2021F |

2022F |

2023F |

2024F |

2025F |

|

Automotive SoC Revenue |

161 |

174 |

188 |

203 |

219 |

236 |

|

Growth % |

8% |

8% |

8% |

8% |

8% |

Source: IHS, Khaveen Investments

Overall, while the company has developed a solid product line of automotive SoCs through its Jacinto product family, we believe that its performance shortfalls limit its vehicle autonomy capabilities at Level 4 compared to stronger competitors.

Strong MCU Product Development

Lastly, the company also have a portfolio of automotive MCU products. Automotive MCUs are used extensively across automotive applications such as infotainment systems, engine control, powertrain, battery management and braking systems. As highlighted in our previous analysis on automotive semiconductors, we analysed the growing MCU content in vehicles and projected a CAGR of 11.18% based on a 20-year average.

|

Company |

2018 |

2019 |

2020 |

2021 |

|

Renesas (OTCPK:RNECF) |

28% |

27.20% |

26.70% |

28.80% |

|

NXP (NXPI) |

28% |

27% |

26.30% |

24.90% |

|

Infineon (OTCQX:IFNNY) |

9.10% |

16.20% |

16.90% |

21.90% |

|

Texas Instruments |

9.90% |

9.80% |

9.80% |

7.50% |

|

Microchip (MCHP) |

6.30% |

6.60% |

6.90% |

7.40% |

Source: Strategy Analytics, Infineon

While Texas Instruments is not the leading player but trails Renesas, NXP and Infineon, it has consistently maintained its market positioning in the past 3 years as the fourth largest player but saw its market share decline in 2021 while Microchip closed the gap with it. Texas Instruments offers a variety of high-performance 32-bit MCUs for more advanced workloads in vehicles. Around three-quarters of the automotive MCU market is on the 32-bit architecture.

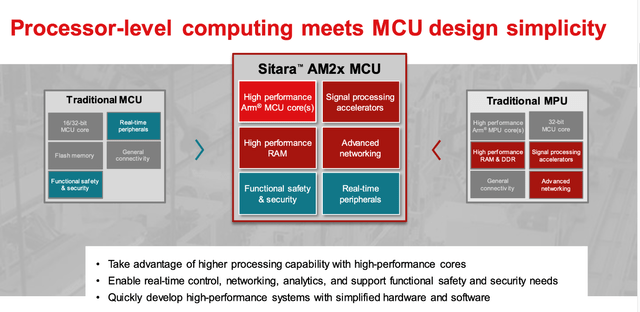

Besides that, it unveiled its new Sitara line of MCUs which integrates advanced memory processing capabilities and is claimed to offer 10 times better performance than traditional flash-based MCUs. As seen in the diagram, the company offers a hybrid-like architecture between MCUs and MPUs with signal processing accelerators and advanced networking components. On top of that, it is developing and integrating a software framework for developers for greater precision control in real-time and networking capabilities and offering reduced system design complexity and costs.

Next, we compared its new MCU lineup against competitors in terms of performance or maximum operating frequency (MHz). Based on the product specifications, TI’s AM243x MCUs have a maximum of 4 cores “Arm Cortex-R5F cores” with each capable of up to 800 MHz. We compared its product against Renesas, NXP and Infineon’s top-tier MCUs and their performances. With the new architecture, we see TI’s MCU portfolio offering a performance advantage over competitors.

|

Company |

Frequency Performance (MHz) |

|

Texas Instruments (AM243x MCUs) |

3,200 |

|

Renesas (RZ/G1M) |

1,500 |

|

NXP (i.MX RT1170) |

1,400 |

|

Infineon (AURIX C3xx) |

1,800 |

Source: Embedded Computing, Renesas, Infineon, NXP

Overall, we view the development of the new Sitara MCU product line to be exciting for the prospects of TI based on initial performance specifications and believe this could enable the company to strengthen its market positioning. To project its revenue growth, we estimated its MCU revenues and projected its MCU revenues to grow at a CAGR of 11.18% based on our previous analysis of MCU content growth.

|

Automotive MCU Forecast ($ mln) |

2021F |

2022F |

2023F |

2024F |

2025F |

|

MCU Revenue |

817 |

908 |

1,010 |

1,123 |

1,248 |

|

Growth % |

11.18% |

11.18% |

11.18% |

11.18% |

Source: TI, Strategy Analytics, Khaveen Investments

Strong Competition in Automotive Sensors Risk

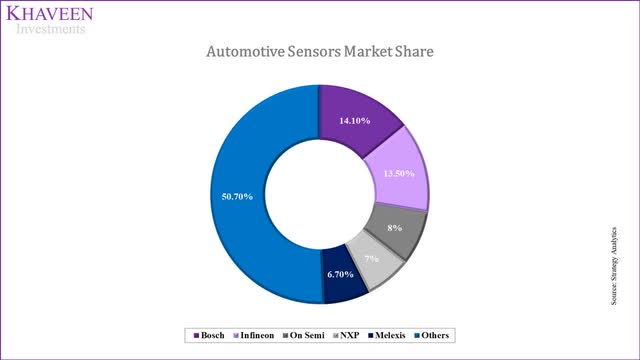

While TI is the fourth in the semicon auto market by market share at 8.3% in 2020 and has an extensive portfolio and development in power ICs, signal chain, MCUs and SoCs, it has been facing tougher competition in the automotive sensor market. In terms of market share from Strategy Analytics, it is placed out of the top 5 in the market. Notably, Infineon and NXP are strong players in this market. The automotive sensor market is projected to grow strongly at a CAGR of 13.6% through 2026 driven by increasing demand for ADAS and AV technologies. We believe this also products Infineon and NXP an upper hand allowing them to integrate their sensor portfolio with its ADAS SoCs. Though, it has been trying to compete more effectively by introducing its mmWave radar sensors to be integrated with its ADAS.

Valuation

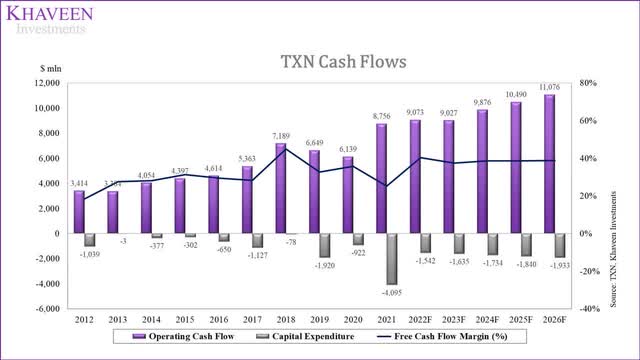

The company had an average revenue growth rate of 7.18% over the past 5 years. Additionally, its gross margin and net margins have a 5-year average of 64.93% and 35.18% respectively.

The company’s FCF margins have had an average of 33.34% for the past 5 years. Its average adjusted capex as a % of fixed assets and revenue are 9.6% and 6.2% respectively.

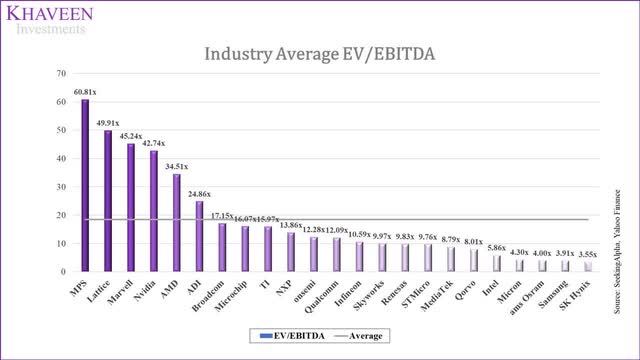

To value the company, we used a DCF valuation as it has strong cash flows. We used an average of the chipmakers’ industry average EV/EBITDA of 18.44x.

SeekingAlpha, Khaveen Investments

We summarized our automotive segment revenues projections based on its MCU, power IC and SoC products as discussed above. Also, we forecasted its other revenue on the automotive semiconductor market forecast CAGR by Brand Essence Research.

|

Automotive Segment Forecast ($ mln) |

2021F |

2022F |

2023F |

2024F |

2025F |

|

MCU Revenue |

817 |

908 |

1,010 |

1,123 |

1,248 |

|

Growth % |

11.18% |

11.18% |

11.18% |

11.18% |

|

|

Automotive Power Semiconductors |

1,233 |

1,319 |

1,411 |

1,510 |

1,616 |

|

Growth % |

7% |

7% |

7% |

7% |

|

|

SoC Revenue |

174 |

188 |

203 |

219 |

236 |

|

Growth % |

8% |

8% |

8% |

8% |

|

|

Others |

1,629 |

1,767 |

1,918 |

2,081 |

2,257 |

|

Growth % |

8.50% |

8.50% |

8.50% |

8.50% |

|

|

Total Automotive |

3,852 |

4,182 |

4,541 |

4,932 |

5,358 |

|

Growth % |

33.19% |

8.6% |

8.6% |

8.6% |

8.6% |

Source: TI, Brand Essence Research, Khaveen Investments

In total, we forecast its revenues for the industrial segment on the industrial IC market forecast CAGR and the remaining revenue on the analog market forecast CAGR.

|

TI Revenues |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Industrial |

5,351 |

7,521 |

7,957 |

8,419 |

8,907 |

9,424 |

|

Growth % |

40.6% |

5.80% |

5.80% |

5.80% |

5.80% |

|

|

Auto |

2,892 |

3,852 |

4,182 |

4,541 |

4,932 |

5,358 |

|

Growth % |

33.2% |

8.6% |

8.6% |

8.6% |

8.6% |

|

|

Others |

6,218 |

6,971 |

7,305 |

7,656 |

8,023 |

8,409 |

|

Growth % |

12.1% |

4.80% |

4.80% |

4.80% |

4.80% |

|

|

Total |

14,461 |

18,344 |

19,445 |

20,616 |

21,863 |

23,190 |

|

Growth % |

26.9% |

6.00% |

6.02% |

6.05% |

6.07% |

Source: TI, Khaveen Investments

Based on a discount rate of 8.8%, our model shows its shares are undervalued by 18%.

Verdict

To conclude, we focused on the company’s automotive segment as its key growth driver and analyzed each of its automotive products. For its power semiconductors, we expect the company to benefit from the growth of power semiconductors in automotive vehicles with its robust portfolio and projected its growth at a CAGR of 7% through 2025. Furthermore, for automotive SoCs, we expect its growth to be supported by its products for ADAS and automotive infotainment with a revenue growth forecast of 8%. Finally, we analyzed its MCU portfolio and see its strong product development which we believe could support its growth with a forecast growth rate of 11.18%. Since our previous coverage, our valuation based on DCF has increased with a higher discount rate. Overall, we rate the company as a Buy with a price target of $201.12.

[ad_2]

Source link