New EV entries nibbling away at Tesla EV share

Even though U.S. electric powered automobile registrations keep on being dominated by

Tesla, the manufacturer is demonstrating the anticipated signs of shedding market

share as extra entrants arrive. Considerably of Tesla’s share loss is to EVs

offered in a more available MSRP array – under $50,000, wherever

Tesla does not nevertheless genuinely contend.

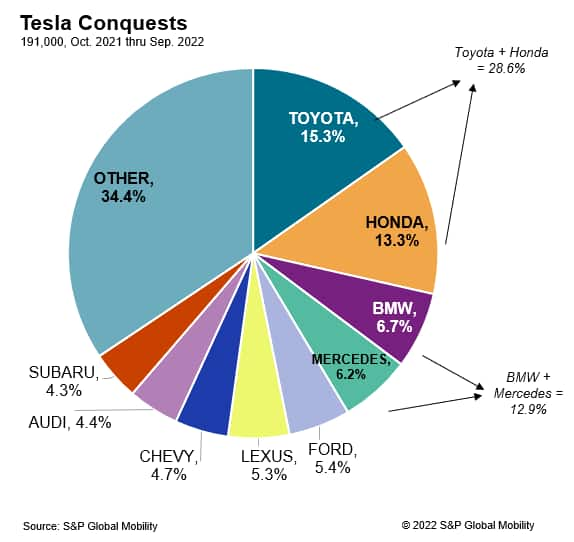

Regardless of brand name or selling price issue, early S&P World

Mobility info suggests shoppers going to electric automobiles in

2022 are mostly accomplishing so from Toyota and Honda – makes which have

been not able to preserve their interior combustion proprietors faithful right up until

their individual brands start to take part additional noticeably in the EV

transition.

When equally Japanese businesses constructed a US legacy with phenomenal

fuel financial state and powertrain systems – together with

electrification by way of hybrids, plug-in hybrids and fuel-cell

electric powered cars – each have been caught flat-footed in the

context of 2022. S&P Worldwide Mobility conquest facts for Tesla’s

Model 3 and Y, Ford Mustang Mach-E, Hyundai Ioniq5, and Chevrolet

Bolt show potent captures of prospective buyers from the two foremost Japanese

manufacturers.

Tesla’s obstacle

So far, most EVs continue on to be obtained for greater MSRPs and by

consumers with higher incomes than the demographic profile for overall

light-weight automobile registrations–in component since most EVs are

Teslas.

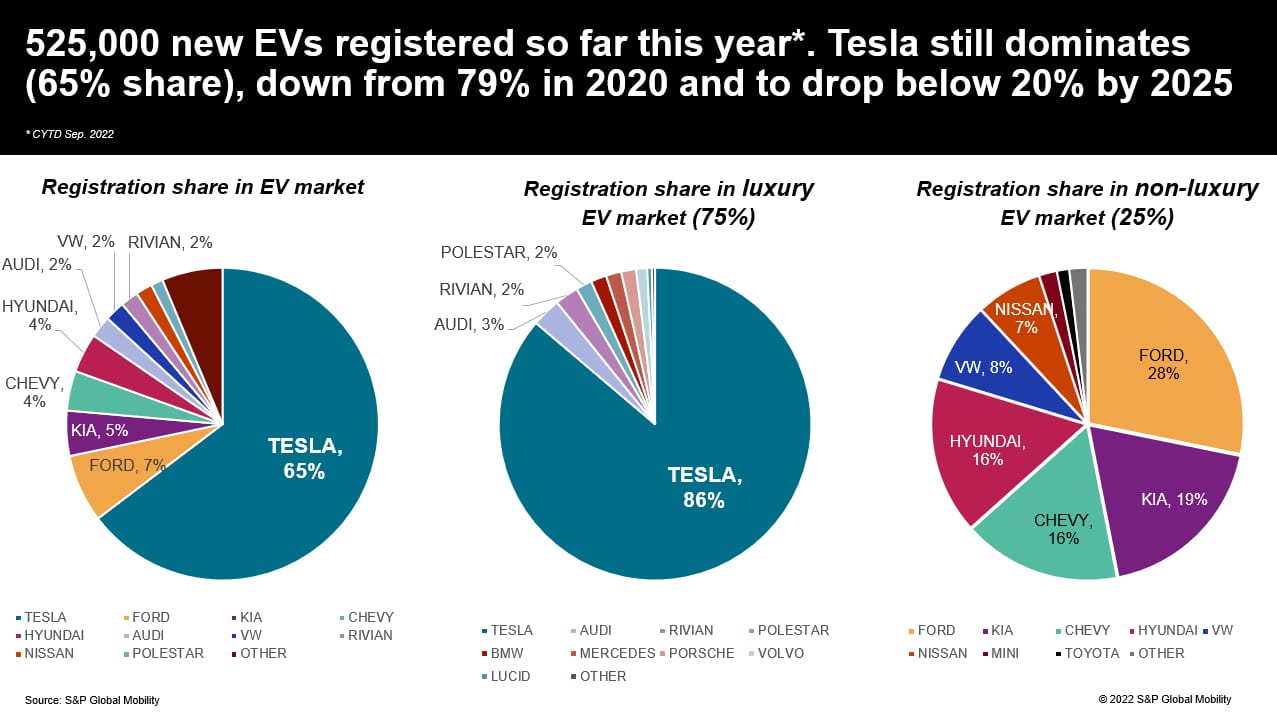

Of extra than 525,000 EVs registered more than the first 9 months

of 2022, nearly 340,000 were Teslas. The remaining quantity is

divided, very inconsistently, among 46 other nameplates. However, the

traits may perhaps modify as the number of EV buyers gets a lot more

sturdy.

Tesla’s posture is modifying as new, much more reasonably priced possibilities

arrive, offering equal or improved technological know-how and manufacturing construct.

Supplied that customer decision and client fascination in EVs are

escalating, Tesla’s potential to retain a dominant industry share will be

challenged heading ahead.

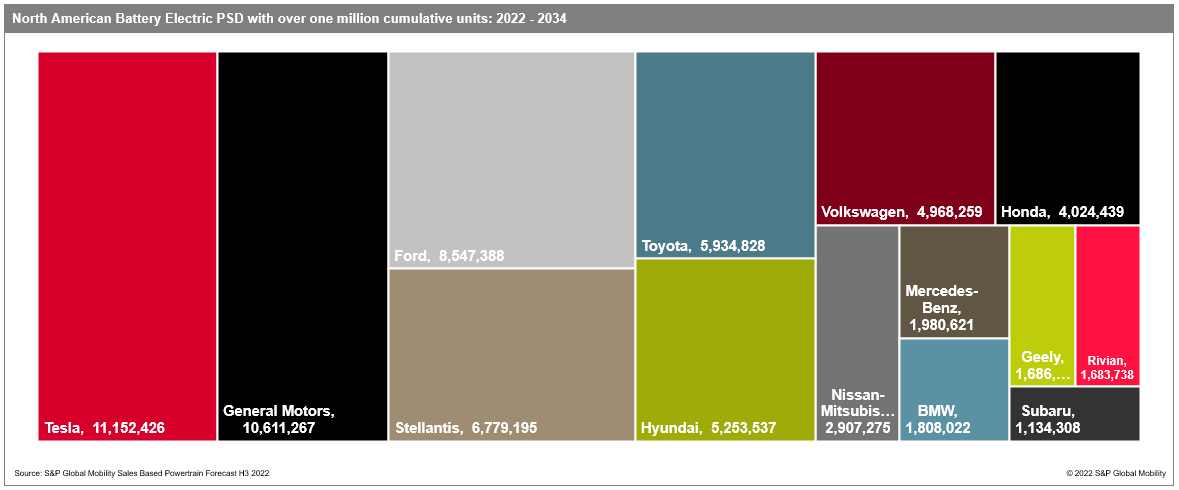

S&P International Mobility predicts the amount of battery-electric

nameplates will develop from 48 at current to 159 by the stop of 2025,

at a rate more rapidly than Tesla will be in a position to insert factories. Tesla’s

CEO Elon Musk confirmed (again) through a new earnings get in touch with that

the company is performing on a car priced decreased than the Product 3,

though market place start timing is unclear.

Tesla’s design array is expected to increase to involve Cybertruck in

2023 and eventually a Roadster, but mainly the Tesla model lineup

in 2025 will be the same styles it features today. (Tesla is also

arranging to supply a professional semi-truck by the close of 2022, but

it would not be factored into light-car or truck registrations.)

“Prior to you experience way too badly for Tesla, nevertheless, try to remember that the

brand will proceed to see unit revenue grow, even as share

declines,” stated Stephanie Brinley, affiliate director,

AutoIntelligence for S&P International Mobility. “The EV current market in

2022 is a Tesla marketplace, and it will continue on to be, so long as its

competitors are sure by output capability.”

Tesla has opened two new assembly crops in 2022 and is seeking

for the web page of its next North American plant. Tesla right now is the

brand best geared up for taking edge of the instant surge in

EV need, while producing investments from other automakers

will erode this gain sooner than later on.

The level of competition

During 2022, EVs have received market place share and buyer

awareness. In an surroundings where car or truck income are constrained by

stock and availability, EVs have attained 2.4 points of sector

share 12 months above calendar year in registration information compiled via

September – reaching 5.2% of all gentle motor vehicle registrations –

according to S&P International Mobility information.

The nascent stage of market advancement leaves many others competing for

quantity at the reduced conclude of the cost spectrum. New EVs from

Hyundai, Kia and Volkswagen have joined Ford’s Mustang Mach-E,

Chevrolet Bolt (EV and EUV) and Nissan Leaf in the mainstream manufacturer

room. In the meantime, luxurious EVs from Mercedes-Benz, BMW, Audi,

Polestar, Lucid, and Rivian – as well as huge-ticket items like the

Ford F-150 Lightning, GMC Hummer, and Chevrolet Silverado EV – will

plague Tesla at the higher conclude of the marketplace.

With the Design Y and Product 3 put together using 56% of EV

registrations, the other 46 automobiles are competing for scraps till

EVs cross the chasm into mainstream appeal. (A recent S&P

World-wide Mobility investigation confirmed the Heartland

states have however to embrace electric powered cars.)

“Evaluating EV market place efficiency calls for hunting by means of a

decreased-quantity lens than with regular ICE items,” Brinley

claimed. “But growth prospective customers for EV solutions are powerful, expenditure

is large and the regulatory atmosphere in the US and globally

indicates that these are the option for the potential.”

Generation volumes these days are limited by factory potential, the

semiconductor shortage and other offer chain challenges, as well

as purchaser desire. But the challenge of production ability is becoming

resolved, as automakers, battery manufacturers and suppliers pour

billions into that aspect of the equation. However there are several

alerts suggesting buyer demand from customers is substantial and that more purchasers may perhaps

be willing to make the changeover – and to do so more quickly than

anticipated even a yr ago.

But shopper willingness to evolve to electrification stays

the premier wildcard. Seeking past Model Y and Design 3, no single

model has reached registrations over 30,000 units by way of the

initially three quarters of 2022. The 2nd-finest-selling EV brand name in

the US is Ford. However, Mach-E registrations of about 27,800 units

are about 8% of the volume Tesla has captured, in accordance to S&P

World-wide Mobility facts.

Tesla has four of the top 5 EV designs by registration in the

sixth by way of 10th positions are the Chevrolet Bolt and Bolt EUV,

Hyundai Ioniq5, Kia EV6, Volkswagen ID.4 and Nissan Leaf. By

September, the Bolt has viewed about 21,600 cars registered,

Hyundai and Kia are in the 17,000-18,000-unit assortment, and VW

approached 11,000 models. Like the tenth-place Leaf, no other

EV has experienced registrations above 10,000 models in excess of the initial 9

months of 2022.

That mentioned, there are caveats. Volkswagen’s minimal volumes are

afflicted by offer chain snarls and marketplace allocations to much more

EV-friendly areas – troubles Hyundai and Kia also deal with. On the other hand,

VW’s new ID.4 assembly line in Tennessee went reside in Oct the

automaker explained at the plant opening that it had 20,000 unfilled

reservations and a plant ability of 7,000 units per thirty day period.

That should really modify the EV volume image noticeably. A search

at the about 525,000 EVs registered around the to start with nine months of

2022 demonstrates the EV marketplace nowadays continues to be in the fingers of affluent

purchasers, who are paying a lot more on their vehicles than ICE

consumers.

While logic dictates that even further expansion will require much more EVs

currently being available in the $25,000-$40,000 rate selection, the willingness

of customers to expend additional today demonstrates an aspirational nature to

the selection.

Tesla’s EV-only strategy offers it a retention advantage – as several

EV house owners have returned to ICE powertrains. But as new EVs arrive,

loyalty will be tested. Now, the Design Y has a 60.5% -model

loyalty and experienced just about 74% of purchasers arrive from exterior the model

(the conquest rate) – tops in the business. Who is Tesla

conquesting from? Toyota, Honda, BMW and Mercedes-Benz. Toyota and

Honda are only starting to get into the EV sector, nevertheless have still

to enter the fray in earnest.

Notice: This chart displays S&P International Mobility North

American cumulative product sales forecast for BEVs 2022-2034.

The race to market place

Honda entrepreneurs in specific are showing an fascination in electrical

cars. However for Honda, its initial EV (a midsize SUV

shared with GM) is not predicted until 2024, whereupon the next

50 percent of this decade sees a flurry of action. That still offers

the challenge of reconnecting with proprietors who have defected from

the Honda model.

In its meteoric expansion, Tesla has conquested Japanese icons: The

leading five Design Y conquests are the Lexus RX, Honda CR-V, Toyota

RAV4, Honda Odyssey, and Honda Accord. In the meantime, the prime 5

Model 3 conquests are the Honda Civic, Honda Accord, Toyota Camry,

Toyota RAV4 and Honda CR-V. So even however the over-all sector has

ditched sedans for SUVs, there continue to be some who like a sedan in

electrified sort.

But it is really not just Tesla winning about shoppers of the big two

Japanese makes. Early information of the 27,800 registrations of the Ford

Mustang Mach-E via September, reveals similar conquest patterns:

The best Mach-E conquest design has been the Toyota RAV4 (irrespective

of powertrain), adopted by the Honda CR-V and Jeep Wrangler. The

Mach-E is also dealing with registrations at a reduce MSRP range –

43% of registrations experienced an MSRP under $50,000. For Ford, much more than

63% of registrations from January by means of September 2022 had been

conquests from other models.

Soon after the Mustang Mach-E, the up coming major EV is the Chevrolet Bolt

(EUV and EV). The Bolt is likely to carry on to achieve ground, as it

invested most of the slide and winter season of 2021-22 in output hiatus

as Chevrolet fixed a warranty concern, and then observed a price tag

reduction soon just after manufacturing re-commenced. With manufacturing again

on line, a additional desirable selling price, and GM’s programs to boost Bolt

potential in 2023, the motor vehicle has possible to hold expanding. The

Bolt also sees RAV4, CR-V and Prius as its best three conquest

designs.

And when the Hyundai Ioniq5 is minimal in its geographic

distribution (and faces identical ability and international desire difficulties

as VW ID.4), S&P Global Mobility conquest details clearly show most Ioniq5

buyers beforehand owned a Toyota RAV4, Honda CR-V, Mazda CX-5 or

Subaru Forester. Of the major 10 Ioniq5 conquests, only two are from

the classic Detroit Three brand names, with the Chevrolet Bolt at

seventh and Jeep Wrangler at tenth.

Of class, the superior conquest premiums from Toyota and Honda come

from the historic revenue success of those people types overall. The RAV4

is the best-marketing non-pickup truck in the US, which implies there

are extra RAV4 consumers to conquest. The Camry, Accord, and CR-V

adhere to near guiding.

Together this route, having said that, these EVs are observing very little conquest

of the F-Series or Chevrolet Silverado pickup truck. In the S&P

World-wide Mobility garage mate information, on the other hand, we see a robust F-Collection

representation. It exhibits up as a leading garage mate for the Mustang

Mach-E the Bolt does see the Silverado as its top rated garage mate, the

F-Series is next. F-Collection is also the top garage mate for the

Ioniq5, EV6 and ID.4.

“Although present-day EV prospective buyers are not offering up their pickups in

favor of going electric, it also suggests that there is a pool of

EV entrepreneurs, who are also comprehensive-dimension pickup owners, being created,”

Brinley reported. “We know that EV owners are inclined to be faithful to EV

propulsion. This intersection can give assist for EV pickup

adoption.”

An current pool of present-day EV homeowners who also have pickups can

be a benefit for the endeavours in the comprehensive-dimension EV pick-up room,

specially for the Ford F-150 Lightning, Chevrolet Silverado EV

and GMC Sierra EV, each individual of which is aimed at a common select-up

use circumstance and owner. The Rivian R1T, GMC Hummer EV and Tesla

Cybertruck every occupy a life style pickup area, geared towards

innovator prospective buyers and statement-makers, and could be more very likely to

conquest prospective buyers to the pickup segment as perfectly as to an EV obtain.

But for now, electric cars continue to be the provenance of sedans and

compact SUVs.

Note: All loyalty data is centered on the S&P International

Mobility household loyalty methodology, which may point out an

addition to the garage and not essentially a disposal.

Make sure you make contact with [email protected] to locate out far more

details close to our insights to aid you make knowledge-driven

conclusions with conviction.

This post was published by S&P World-wide Mobility and not by S&P Worldwide Scores, which is a individually managed division of S&P Global.