Fuel For Thought: What Do Capital Markets Tell Us About The Automotive Industry?

[ad_1]

deepblue4you/E+ via Getty Images

Although financial markets grab headlines when fear and volatility are highest, the same markets do also function rationally, and are a window into an ongoing re-evaluation of companies’ prospects and risks. So, what can we learn from the state of the markets today?

The autos sector contains some of the cheapest and the most expensive companies in the world. This simultaneously reflects both the inherent challenges of legacy carmaking, and the markets’ hopes for the future beneficiaries of change. In recent months, automotive startups have faced a stark valuation reality check, and the virtual closure of the SPAC funding route reflects far greater scrutiny from investors. Further capital displacements are likely in the coming years as a lumpy technological transition plays out all along the supply chain. None of this has fundamentally changed the broad long-term outlook for electrification. Meanwhile near-term, there is plenty of turbulence – notably from currency, largely to the detriment of US automakers.

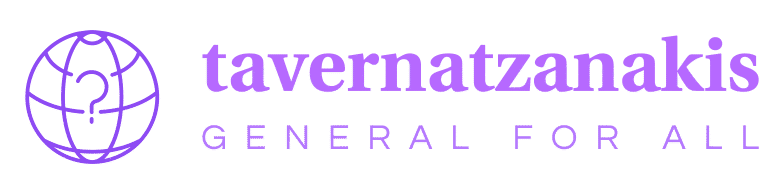

Autos is the most polarised sector

The automaking sector is in the unusual position of containing both some of the cheapest – and some of the most expensive listed companies in the world. On one side, legacy established automakers – like VW (OTCPK:VWAGY) trades at around 4.5 times its expected 2022 earnings. At the other end, tech-focused electric vehicle makers notably Tesla (TSLA) for which this figure is 52 times, (vs. for comparison Alphabet (GOOG) (GOOGL) 18x, Apple (AAPL) 22x, and Amazon (AMZN) 61x) – plus various as yet-unprofitable startups for which no such calculation is yet possible.

12-month forward consensus

Legacy autos’ valuations reflect inherent challenges

Automakers like VW have traded inexpensively relative to their earnings for many years. There are many reasons why: Sector profitability is low compared to its capital requirements. Balance sheet risk is high due to inventory requirements and the need to pay (and also effectively underwrite) the risks of component suppliers and dealer networks. This in turn means bankruptcy risk in economic downturns is significant. The new cohort of startups promises to address many of these: Lower mechanical complexity means lesser capital requirements, and simpler supply chains. Less maintenance means few or no traditional dealers and lower inventories. For this group, being electric-only is the enabler.

Relative growth expectations underpin the valuation gap

However, the clearest justification for the valuation gap is the growth differential. This year-to-date, global battery electric vehicle sales grew 68% vs. prior year, while total light vehicles contracted by 13%. Legacy automakers access to that growth is limited since even BEV transition leaders like BMW (OTCPK:BMWYY) and VW have around 6% BEV in their sales mix. Ultimately, legacy automakers are fighting to defend a $2.5tn market, while new automakers aspire to capture it – with little to lose.

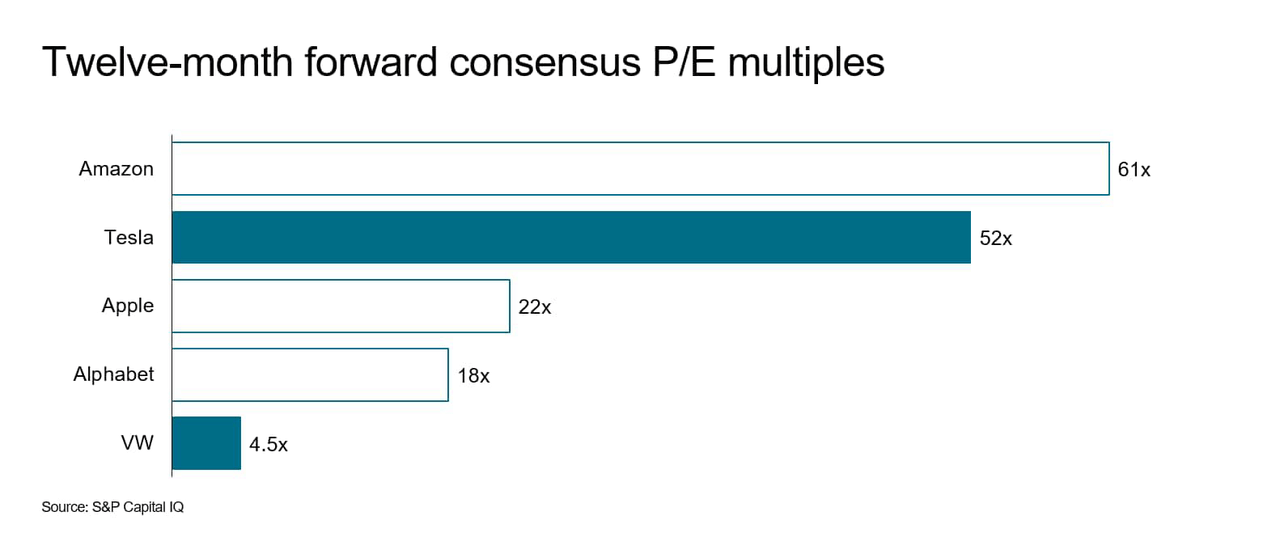

Investor appetite for ‘New autos’ has waned dramatically

New automakers’ valuations have undergone stark adjustments in the past year. The chart below lists a selection of electric carmakers and their current market values relative to their respective peak levels. These moves are partly macro-driven: Economic conditions have become more difficult globally, with growth slowing, inflation up, and appetite for risky assets in general significantly down. However, the key shift is perhaps growing recognition of the difficulties inherent in starting and scaling automotive production from scratch.

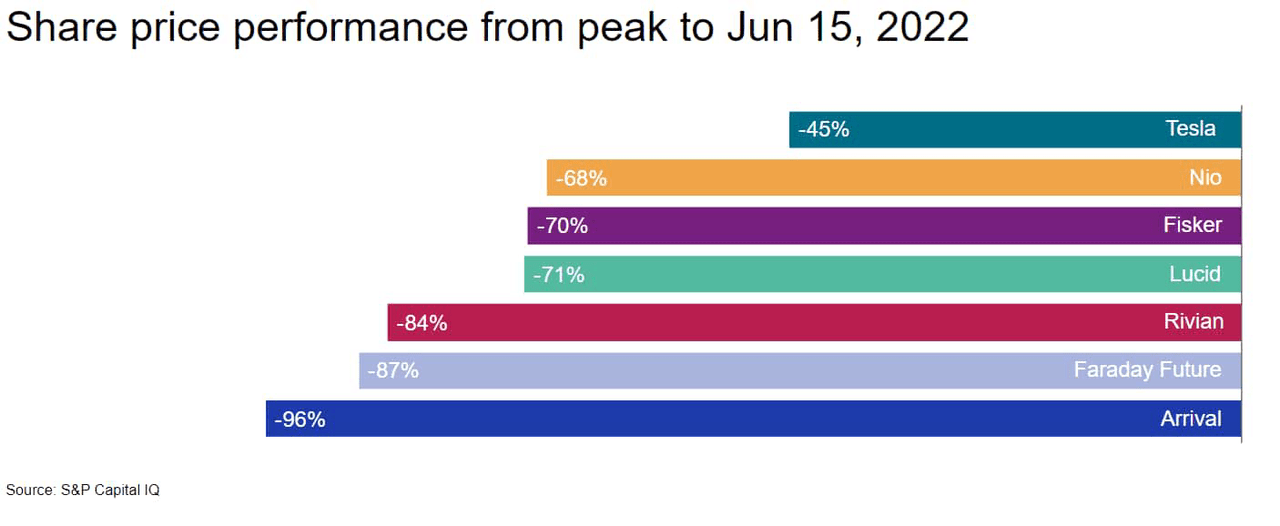

Preferred funding route now closed

At the same time, the popularity of fundraising via the SPAC (special purpose acquisition company) route has ground to a virtual halt, with 69 such transactions in 2022 to date versus 613 during 2021. EV companies that went public via the speculative ‘blank cheque’ method in 2021 included Fisker (FSR), Polestar (PSNY), Lucid (LCID), and Arrival (ARVL). Companies now wishing to follow in their footsteps are likely to significantly greater financial scrutiny.

Share price performance SPAC IPO transactions

A bumpy transition

Early market euphoria has not given way to the reality of the task in front of us. Undoubtedly the growth of BEVs and the commensurate decline in ICEs (Internal Combustion Engine) will be the industry’s most critical transition since its inception early last century – this will certainly not be smooth. A transformation which significantly impacts all facets of the mobility ecosystem – innovation, vehicle development, system sourcing, production dynamics, retail engagement and the aftermarket – will be “bumpy”. This will be uncharted territory at virtually every level. Transition speed, commitment by stakeholders (consumers, government, dealers etc.), securing upstream battery raw materials, altered logistic streams, consumer acceptance/education and an all-new service dynamic all cloud the sky. The current ICE-focused ecosystem took us over a century to hone – expecting a transformation with little drama through the next decade is not realistic.

Capital displacement is likely across the ecosystem

The prospect for capital displacement is high at all levels of the ecosystem. Case in point are the component suppliers. Critical to future innovation, re-investment and most of the current vehicle value add, several suppliers in system areas which disappear in the BEV world are faced with key decisions. The options are to stand pat and ride the volume decline, pivot, and focus efforts on systems key to the BEV space, double-down and be a consolidator in a declining market, or simply sell the operation. Timeframes will vary though the displacement is undeniable. There will most certainly be winners and losers during the transition.

Electrification has not been derailed

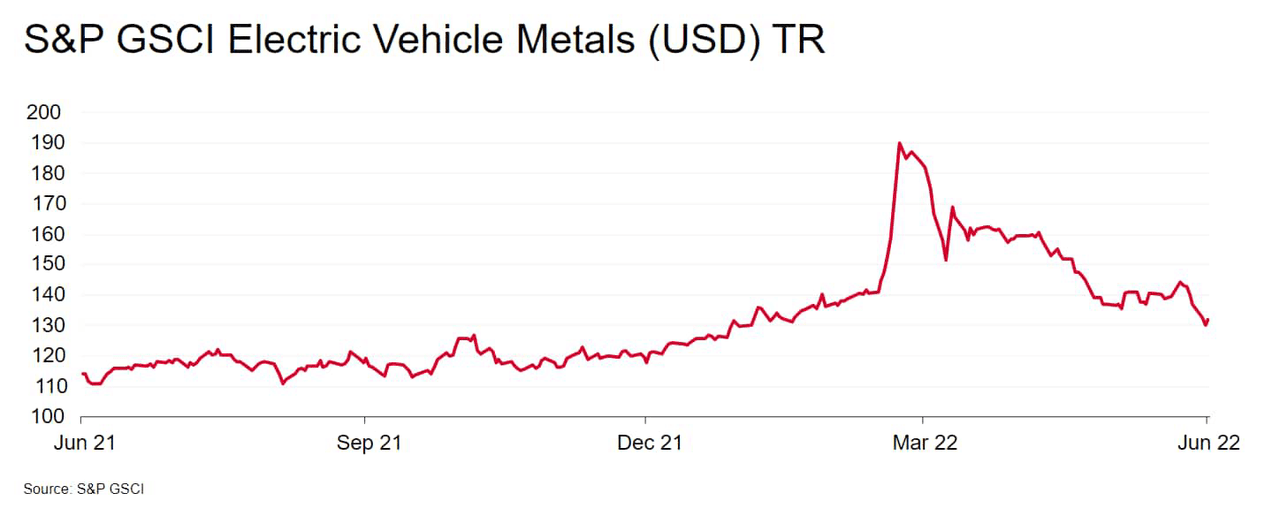

Despite the ensuing ecosystems shifts, does this mean electrification now won’t happen, or will happen slower? There is limited evidence of large changes to the fundamental outlook. For one, the post-Ukraine surge in battery raw material prices has abated somewhat, while still-elevated gasoline prices provide support to BEV ownership costs on a relative basis. Furthermore, regulatory momentum continues to work in favour of electrification, with the EU parliament notably voting in early June to ban new internal combustion sales from 2035, albeit still subject to agreement from prominent opponents such as Germany.

Electric Vehicle Metals

The shifting sands of currency

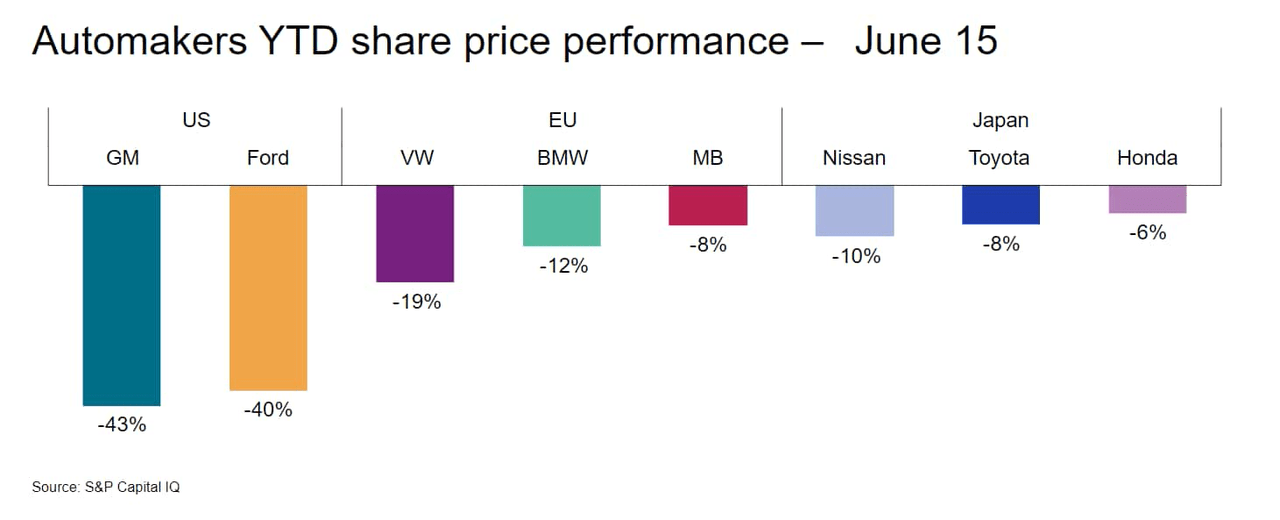

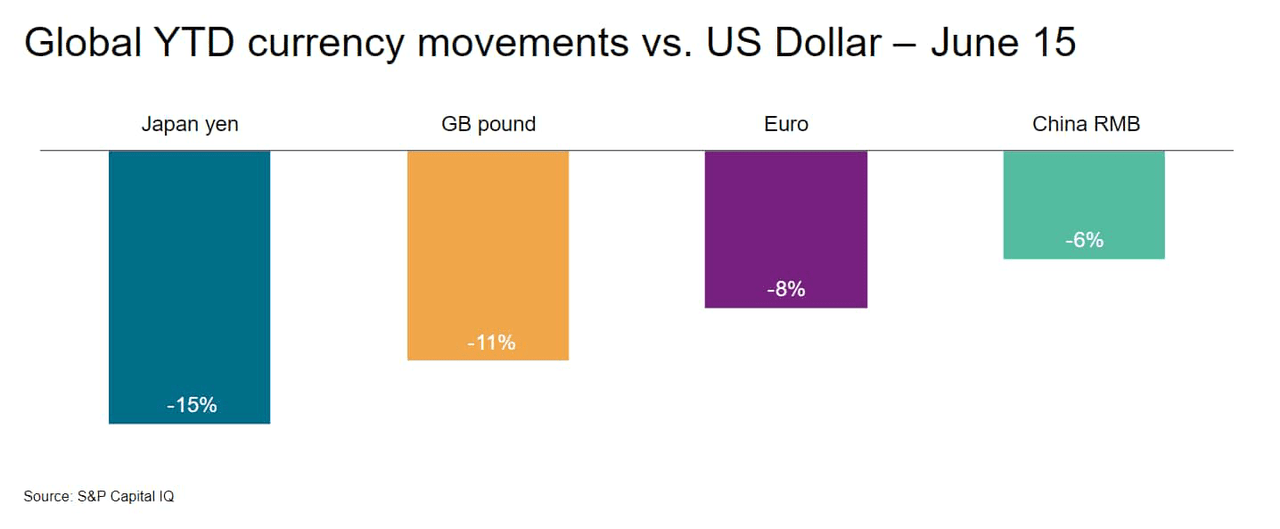

Finally, a note on currency movements. Global automakers’ fortunes are to some extent a function of central banks’ potentially divergent approaches to tackling inflation in the coming years. Specifically, a strong US dollar is creating headaches for US domestic carmakers, and a boost to those elsewhere. The dollar’s 19-year high vs. other currencies (USDX index) hurts GM (GM) and Ford (F) because their income from overseas operations is brought home at a less favourable exchange rate. Conversely, a strong dollar is good news for automakers outside the United States, whose overseas profits are boosted by currency effects. Whether investing outside the United States makes sense depends on one’s perspective: A US investor in Nissan (OTCPK:NSANY) would have seen its shares fall only 10% but would have lost another 15% from the weakening yen.

Automakers YTD performance Global currency movements vs. USD

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source link